martinaquisenb

About martinaquisenb

No Credit Test Loans: A Lifeline for These with Bad Credit Score

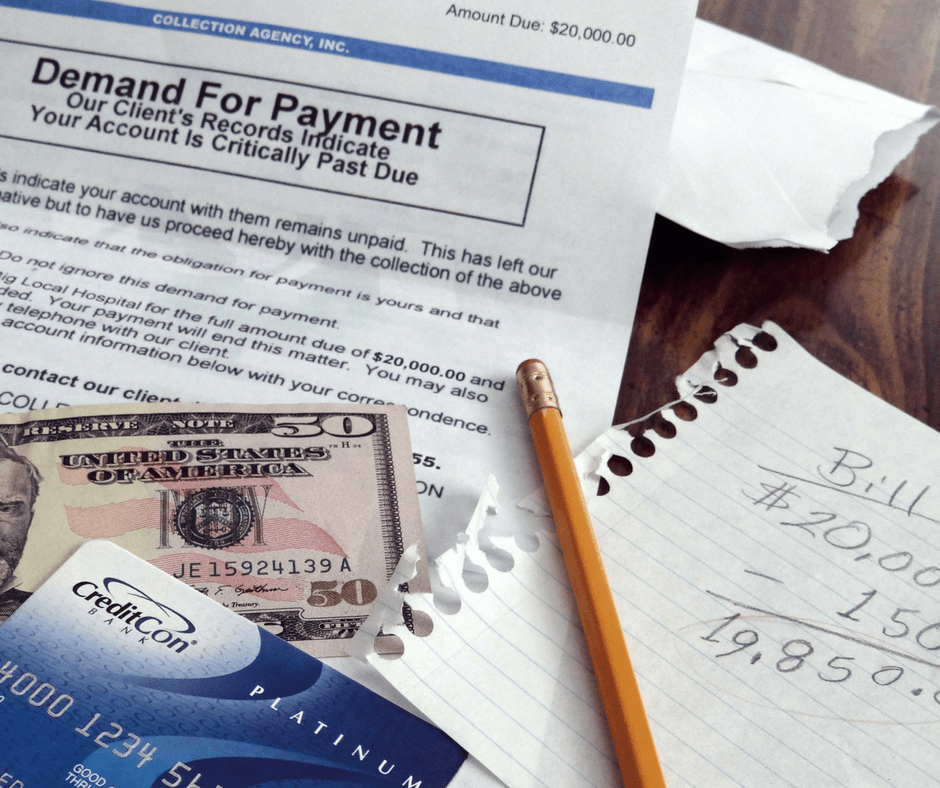

In today’s financial climate, many people discover themselves in precarious monetary conditions, often leading to the need for quick access to funds. For these with poor credit score histories, traditional lending avenues can seem closed off, leaving them feeling trapped. Nevertheless, no credit verify loans have emerged as a potential resolution for people facing monetary hardship. These loans provide a method for individuals with bad credit to safe funds without the rigorous scrutiny that usually accompanies conventional lending practices.

Understanding No Credit score Check Loans

No credit check loans are monetary merchandise that allow borrowers to acquire funds with out having their credit score historical past reviewed by lenders. Such a loan is particularly interesting to those with dangerous credit score scores, because it bypasses one of the most important boundaries to conventional lending. As a substitute of evaluating a borrower’s creditworthiness through a credit score report, lenders may consider other elements equivalent to income, employment standing, and financial institution statements.

These loans are available various kinds, together with payday loans, private loans, and installment loans. Every sort has its own phrases, curiosity charges, and repayment schedules, so it is essential for borrowers to know what they are signing up for earlier than committing.

The Enchantment of No Credit score Check Loans

The primary attraction of no credit score check loans is their accessibility. For individuals who might have skilled monetary difficulties due to job loss, medical emergencies, or other unexpected bills, these loans can present rapid relief. Unlike conventional lenders who might take days or even weeks to process purposes, many no credit verify lenders offer fast approval processes, with funds often disbursed inside 24 hours.

Additionally, the applying process for no credit examine loans is usually straightforward. Borrowers can usually apply online, providing basic information about their income and monetary situation with out the necessity for extensive documentation. This ease of access might be a significant advantage for those in urgent want of funds.

The Risks Concerned

While no credit examine loans can be a lifeline for many, they aren’t with out their pitfalls. One of the most significant issues is the high-curiosity rates associated with these loans. Lenders often cost exorbitant fees to compensate for the increased threat they take on by lending to individuals with poor credit score. Consequently, borrowers may find themselves trapped in a cycle of debt, struggling to repay their loans while accruing additional curiosity and fees.

Moreover, the phrases of no credit score test loans may be less favorable than these provided by traditional lenders. Borrowers may face short repayment durations, which may lead to additional financial strain if they’re unable to pay back the loan in time. In some cases, lenders may additionally impose penalties for late payments, further exacerbating the borrower’s financial situation.

Alternatives to No Credit Check Loans

For people with bad credit who’re considering no credit score examine loans, it is important to discover different choices. Some potential options embrace:

- Credit Unions: Many credit score unions offer small personal loans to members, typically with more favorable terms than conventional banks. They might even be extra willing to work with people with much less-than-excellent credit score.

- Peer-to-Peer Lending: Online platforms that connect borrowers with individual traders can provide one other avenue for securing funds. These platforms typically have extra versatile lending criteria in comparison with traditional banks.

- Secured Loans: For those who personal beneficial assets, similar to a car or home, secured loans can be an choice. These loans require collateral, which may help reduce the risk for lenders and will result in decrease interest charges.

- Payment Plans: If the monetary want is expounded to medical bills or different expenses, negotiating a fee plan with the service supplier may be a viable choice. Many suppliers are keen to work with individuals to set up manageable fee schedules.

Making an Informed Resolution

Before opting for a no credit test loan, it’s crucial for borrowers to conduct thorough analysis and consider their monetary situation carefully. Listed below are some suggestions to help individuals make informed choices:

- Learn the High quality Print: Understanding the terms and situations of the loan is important. Borrowers ought to be aware of the interest rates, repayment terms, and any potential fees associated with the mortgage.

- Assess the total Value: Calculate the overall quantity that will need to be repaid, including curiosity and charges, to determine if the mortgage is a financially viable choice.

- Consider the Impact on Future Credit score: Taking out a no credit score examine loan can have an effect on an individual’s monetary future. If the mortgage will not be repaid on time, it might result in further injury to an already poor credit score score.

- Seek Monetary Counseling: Consulting with a financial advisor or credit score counselor can present valuable insights and assist people explore their choices more comprehensively.

Conclusion

No credit check loans can present a obligatory financial solution for individuals facing pressing financial wants, particularly those with bad credit score. Nonetheless, the associated dangers and costs require cautious consideration. By exploring different options and making informed selections, borrowers can navigate their monetary challenges extra effectively. Finally, while no credit verify loans may serve as a short lived repair, lengthy-time period monetary well being relies on building better credit score and establishing sustainable financial habits. If you cherished this write-up and you would like to receive a lot more info regarding bestnocreditcheckloans.com kindly go to the web site. As all the time, it is essential for individuals to weigh the professionals and cons earlier than committing to any financial product.

No listing found.